By Clare M. Urbanski and Thomas R. Knight

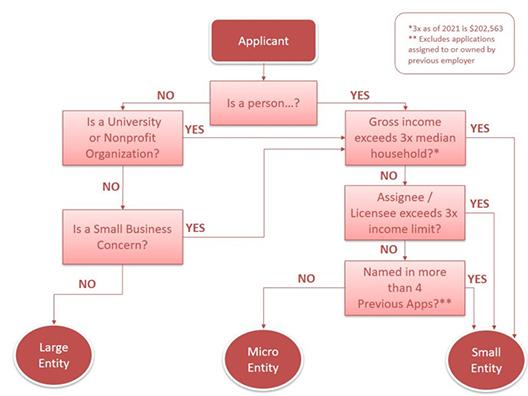

With U.S. Patent and Trademark Office (USPTO) fees escalating over the years, understanding the availability of discounts can be crucial for smaller applicants. Specifically, applicants qualifying as “Small Entities” or “Micro Entities” are eligible for discounts on many USPTO fees (relative to the standard fees for “Large Entities”). Determining whether an applicant qualifies for small or micro entity status takes into account qualifications such as gross income, the number or patent applications previously filed, and university affiliations.

Small Entity Status

Qualifying for small entity status can significantly reduce fees for applicants who fall into one of three categories: a person, a small business concern, or a non-profit organization. A “person” is defined as any individual or inventor who has rights in the invention. A “small business concern” is a business having no more than 500 employees and affiliates (which includes employees of related entities, such as subsidiaries). Additional applicants considered to be small entities (irrespective of size) and falling into the “non-profit organization” category include institutes of higher education in the U.S., Section 501(C)(3) or equivalent tax-exempt organizations, and foreign organizations that would meet these requirements if located in the U.S.

It is important to note that requesting small entity status also requires that the patent rights have not been (and are not obligated to be) assigned, granted, conveyed, or licensed to an entity that does not meet the small entity status requirements. An exception is made for licensing to the U.S. Government, which would not invalidate the small entity status.

Micro Entity Status

Of those applicants meeting the requirements for small entity status, small business concerns, individual applicants, and applicants working for institutes of higher education may further qualify for micro entity status and its associated additional fee discounts.

In the case of individual applicants, neither the applicant, nor any inventor named in the application, may be listed in more than four previous non-provisional U.S. patent applications. Furthermore, none of the inventors may have earned more than three times the U.S. median household income in the year prior to the application. In 2021, the USPTO set this limit at approximately $200,000 (see https://www.uspto.gov/patents/laws/micro-entity-status). This income limitation extends to any party to which the patent rights have been (or are obligated to be) assigned, granted, or conveyed.

Applicants employed by higher education institutions may qualify for micro entity status under separate requirements. First, the applicant must be employed by, and earn the majority of their income from said institution. Second, the patent rights must have been (or are obligated to be) assigned, granted, or conveyed to the institute of high education.

Additional Limitations

In order to receive the fee reductions and benefits of the small or micro entity status, applicants must follow certain regulations. The status must be stated before the application fee is paid, which can be done in writing, or simply by paying the reduced fee for either the small or micro entity status. Once certified, this status remains in effect unless the applicant notifies the USPTO of a change of status. Changes in eligibility require proactive notification to ensure that fee payments correspond to the accurate entity qualifications.

For qualifying applicants, these discounts are intended to make patents more attainable. As shown in the table above, these discounts can be substantial, typically 50% reduced for small entities and 75% reduced for micro entities.

If you have questions regarding entity status or expected U.S. patent fees, please do not hesitate to contact your Andrus attorney.

Andrus attorneys Aaron Olejniczak, Joseph Kuborn and Edward Williams were selected for inclusion in The Best Lawyers in America 2022 Edition.

In August, Andrus Intellectual Property Law sponsored the Milwaukee Bar Association’s golf outing benefitting the MBA Foundation with the Milwaukee Justice Center (MJC) as its chief project. The MJC is a collaborative project between the Milwaukee Bar Association, Milwaukee County, and Marquette University Law School. It utilizes volunteers to address the unmet legal needs of Milwaukee County's low-income unrepresented litigants through court-based programs and legal resources.